Option Income Strategy Funds: Generate Income in TSLY, KLIP, OARK, and APLY

An "income option fund" is an investment fund that primarily seeks to generate income for its investors by using options strategies, typically writing or selling options. Here's a breakdown:

- Options: These are financial instruments that give an investor the right, but not the obligation, to buy or sell an asset (like stocks) at a certain price within a specific period.

- Writing/Selling Options: This is where the fund sells options to other investors. When these options are sold, the fund receives a premium (basically a fee). This premium provides income.

- Strategy: The primary goal is to generate steady income from the premiums collected from selling options. This is in contrast to other funds that might aim for growth by hoping the assets they hold increase in value.

- Trade-Offs: While these funds can provide regular income, they might miss out on some potential gains. For example, if they've sold an option that caps their potential profit from a stock, and that stock's price shoots up, they only benefit up to that capped amount.

In simple terms, an income option fund aims to earn steady income by selling options on assets they hold, rather than just banking on those assets increasing in value.

Evolving Investments: Option Income Strategy Funds

The landscape of investment funds continues to evolve rapidly with the rise of various innovative strategies. Among these are the 'Option Income Strategy Funds' that have recently been gaining popularity. Four names that have been at the forefront of this strategy include TSLY, KLIP, OARK, and APLY. Let's take a closer look.

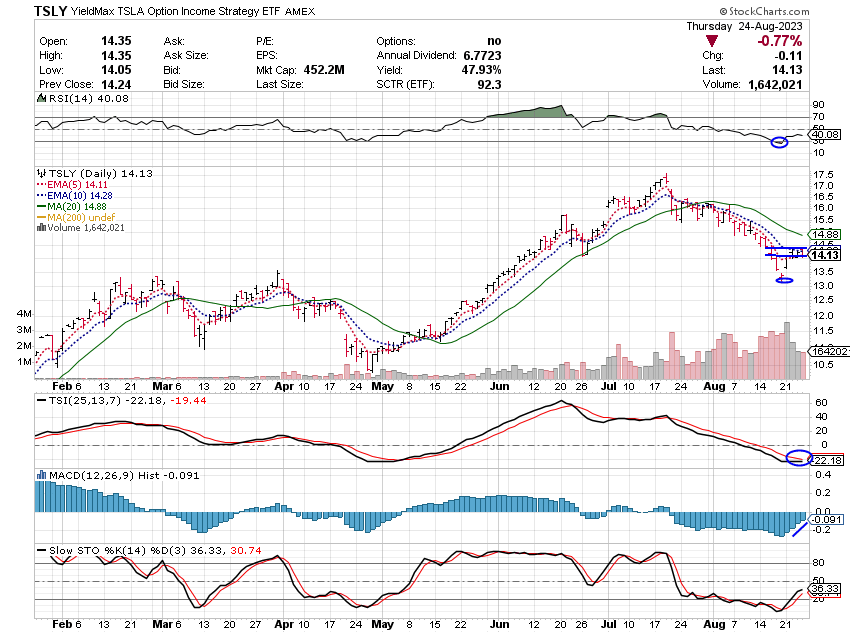

TSLY

TSLY stands out as one of the pioneering funds in the option income strategy space. They utilize a unique approach where they write (or sell) call options on a subset of stocks in their portfolio. The premiums collected from selling these options generate income for the fund.

This strategy can provide steady income streams, especially in flat or slowly rising markets. However, like all strategies, there is a risk. If the market rapidly appreciates, the fund might miss out on potential gains because they've effectively capped their upside through the sold call options.

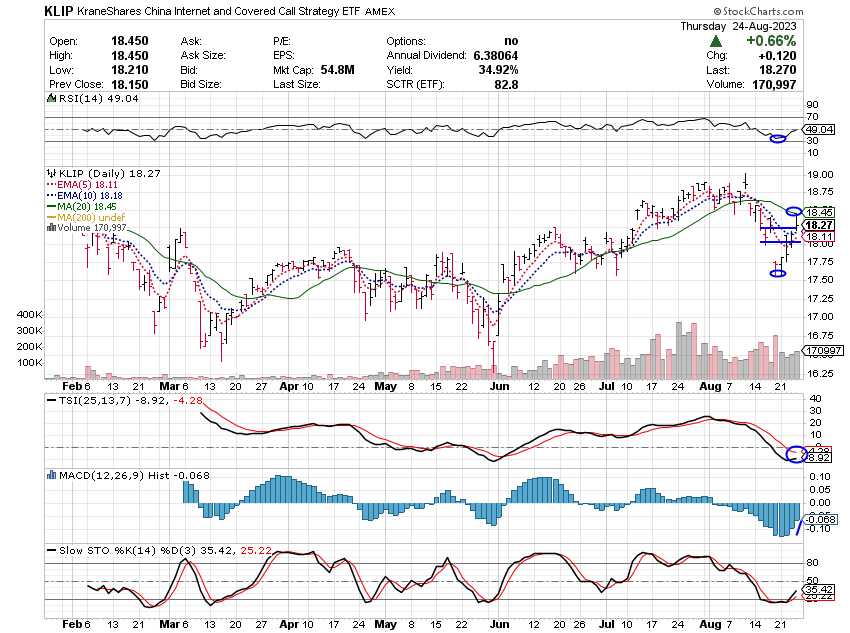

KLIP

KLIP takes a slightly different approach. Instead of focusing solely on stocks, KLIP's portfolio incorporates a mix of stocks and bonds. They apply the option writing strategy predominantly on their equity holdings.

This dual approach is intended to offer investors a balance of income (from option premiums) and capital appreciation (from bond interest and potential stock price growth). It also aims to hedge against sharp market downturns, as bonds generally provide more stability.

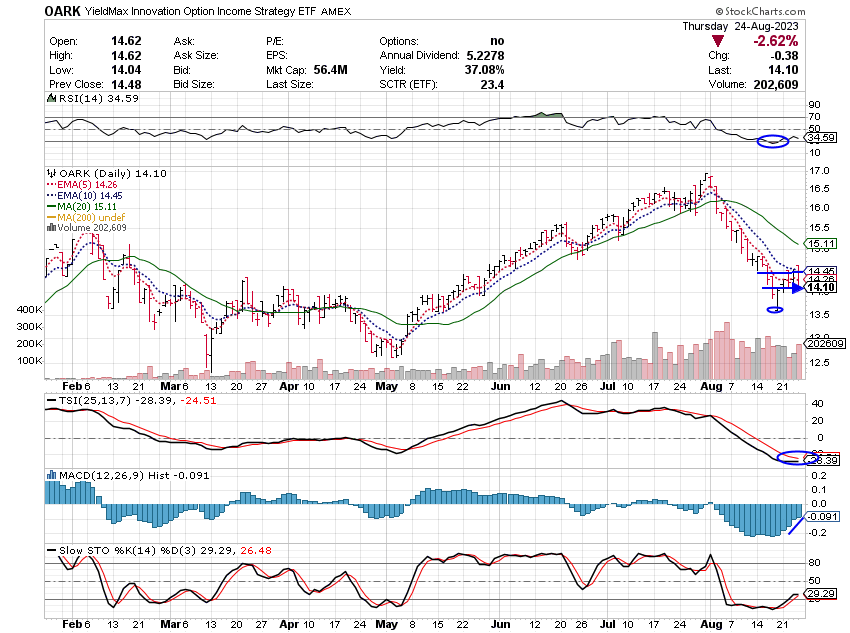

OARK

OARK stands out due to its adaptive strategy. The fund managers dynamically adjust the number of options they write based on market conditions. In more volatile conditions, they might increase their option writing to capitalize on higher premiums.

Conversely, in more stable times, they might reduce option writing to capture more of the potential upside from their stock holdings. This adaptability makes OARK particularly attractive to investors who want a more managed exposure to this strategy.

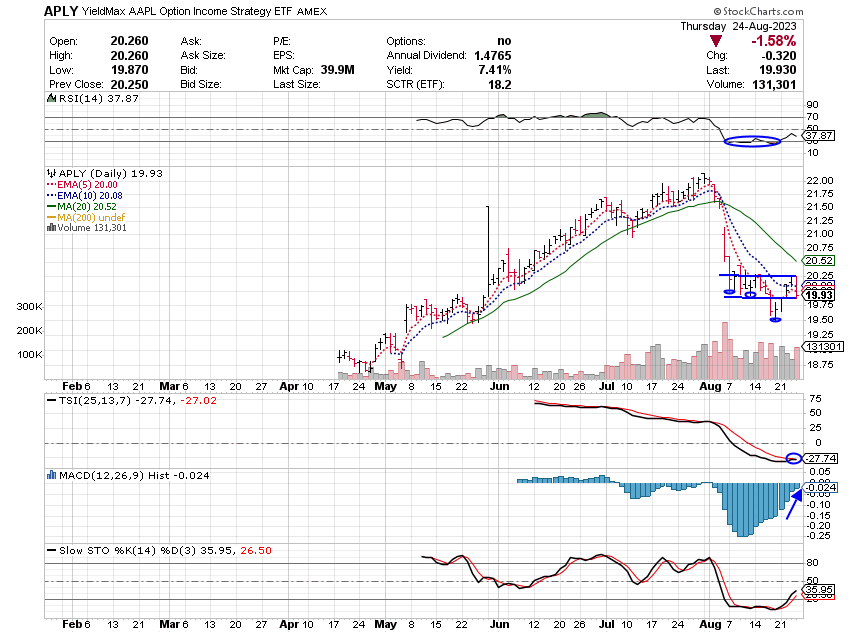

APLY

APLY focuses primarily on international stocks, giving investors an opportunity to generate option income from markets outside the U.S. They blend this with a small mix of domestic equities, but their primary appeal is the diversification they provide. Investors can potentially benefit from different market cycles and conditions across various countries, all while employing the option writing strategy.

Final Thoughts

Option Income Strategy Funds like TSLY, KLIP, OARK, and APLY provide an intriguing blend of potential income and capital appreciation. While they can offer steady returns in certain market conditions, it's crucial for investors to understand the inherent risks, especially the potential for capped upside in sharply rising markets. As always, diversification remains a cornerstone of investment, and these funds can be a valuable part of a well-balanced portfolio.

Thank you for reading this article.

FINANCIAL DISCLAIMER

This is not financial advice, but education to increase awareness. Before making investment decisions, always do thorough research and possibly consult with a financial advisor. The above descriptions are a broad overview and may not capture all nuances associated with each fund.